Do you want to learn how to log in to Plaid? If so, you’ve come to the right place! This article will show you how to log in to Plaid, a financial technology company that allows you to connect your bank account to a wide range of applications.

Plaid is a financial technology company that allows developers to connect to bank accounts. This allows developers to build financial applications that can, for example, track spending, make payments, or get loans.

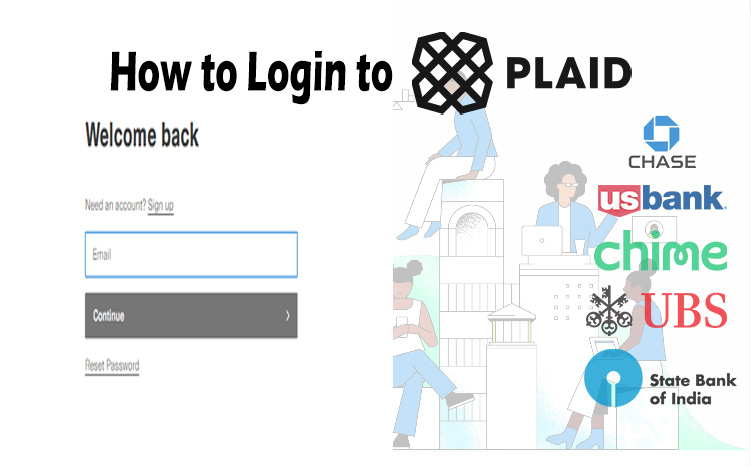

How To Login To Plaid

If you’re looking to sign in to your Plaid account, the process is straightforward and can be completed by following a few simple steps. Here are the steps on how to sign in to Plaid:

- Go to the Plaid website.

- Click on the login button.

- Enter your email address.

- Click Continue.

- Enter your password.

- Click on the Sign In button.

You should be logged into your account if you followed this instruction carefully. Also, you can now access your Plaid dashboard and connect your bank account to apps run by financial services.

What is Plaid?

Plaid is a financial technology company that provides APIs (application programming interfaces) that allow developers to connect to bank accounts. This allows developers to build financial applications that can, for example, track spending, make payments, or get loans.

It was founded in 2013 by Zach Perret and William Hockey. It has raised over $1 billion in funding from investors such as Goldman Sachs, Spark Capital, and Thrive Capital.

Plaid’s APIs are used by a wide range of financial applications, including Venmo, Acorns, and Wealthfront. It also partners with banks to provide their customers with access to financial applications.

Supported Banks And Credit Unions

Plaid works with a lot of banks and credit unions in the United States, Canada, and the United Kingdom. So, here are all the banks that you can link to:

- Academy Bank – Personal

- Access Bank – Personal

- ACSC (Auto Club Southern California)

- AIG Federal Savings Bank

- Alcatel-Lucent Pension Website

- Alliant Credit Union

- Ally Bank

- American Express

- Apmex

- Arvest Bank – Online Banking

- Aspiration

- Avenue – Credit Card

- Bank of America

- Bank of England (AR)

- Bank of the West (TX) – Personal

- BankWest

- Barclaycard

- BMO Bank of Montreal

- Branch

- Central Bank

- CIBC

- Citizens Bank

- Commerce Bank

- Commonwealth Bank (MA)

- Commonwealth Funds – Client Access

- Cross River Bank – Personal

- Desjardins

- Discover

- E*TRADE Financial

- Edward Jones

- Empower Federal Credit Union

- Equity Bank

- Fidelity

- Fifth Third Bank

- First Advantage – Personal

- First Bank

- Firstrade

- FNB

- FNB Bank (KY)

- GAM

- Goldman Sachs Private Wealth Management

- Goldmoney

- Heritage Bank of Nevada

- Huntington Bank

- Interactive Brokers – US

- InterBank

- Intralinks

- KeyBank

- LendUp

- M1 Finance

- Magnolia Federal Credit Union

- Marcus by Goldman Sachs

- Mercury

- Meridian

- Merrill Edge

- Merrill Lynch

- Metrobank (NY)

- Metropolitan Commercial Bank (NY) – Personal

- Morgan Stanley Client Serv

- Mos

- myCigna.com

- Nationwide Advantage Mortgage

- Navy Federal Credit Union

- NEA Member Benefits

- Nelnet – Education Financing

- North Shore Bank

- Novo

- Oxygen

- Pac

- Pinnacle Bank (CA) – Personal

- Point

- Prudential Retirement

- Regions Bank

- RIA Federal Credit Union

- Santander – Personal

- Scotiabank

- ShareKhan

- Signature Bank

- Silvergate Bank – Personal Online Banking

- Stage

- Standard Bank – Personal

- State Bank of India (California) – Personal

- State Farm 529 Savings Plan

- Step

- Sterling Bank and Trust

- Summit Bank – Business

- Sutton Bank (OH) – Online Banking

- Synchrony Bank

- Tangerine – Personal

- TD Bank

- Trust Point – Sunguard Asset Management Systems

- TSX – My Stock List

- U.S. Bank

- Union Bank

- Vanguard

- Virtual Bank

- Warren FCU

- Wells Fargo

It is important to note that not all banks and credit unions support Plaid. If your bank is not supported, you may not be able to link your account to Plaid. You can find a detailed full list of supported banks and credit unions on the Plaid institutions website.

How To Link Your Bank Account To Plaid

To be able to use the platform, and enjoy the benefits of the platform, you have to link your bank accounts first. So, here is how you can link your bank account to Plaid, just follow these steps:

- Go to the Plaid website or app.

- On the Plaid dashboard, click on Link.

- Click on the link Customization button.

- Click on the settings icon in the top right corner to select your country.

- Select your bank from the list of supported banks.

- Enter your bank account number and routing number.

- If you are prompted, enter your username and password for your online banking account.

- Click on the Link Account button.

It will then connect to your bank account and verify your identity. Once the verification is complete, your bank account will be linked to Plaid.

You can also link your bank account to Plaid through a financial application that uses Plaid. To do this, you will need to follow the instructions provided by the financial application.

Things You Can Do With Plaid

Once you have linked your bank account, you can start using financial applications that support it. These applications can help you track your spending, invest your money, and get a loan. Here are some of the things you can do with financial applications that use Plaid:

- Track your spending.

- Budget your money.

- Save for your goals.

- Invest your money.

- Send and receive money.

- Get loans.

To link your bank account to Plaid, you will need to provide your bank account number and routing number. You may also need to provide your username and password for your online banking account.

Is It Safe?

Plaid is a safe and secure way to connect your bank account to financial applications. Also, it uses industry-standard security measures to protect your data.

Moreso, it is a safe and secure way to connect your bank account to financial applications. It uses industry-standard security measures to protect your data, including encryption protocols like the Advanced Encryption Standard (AES 256) and Transport Layer Security (TLS). Also, it follows a number of other security best practices, such as using multifactor authentication (MFA) and operating a bug bounty program. Additionally, Plaid promises that they will never share your data without your permission. Also, never sell or rent your information to other companies.

Also, if you have any problems logging in to Plaid or linking your bank account, you can contact Plaid customer support for help.